Table of Content

Before the rate cut, the housing finance company was charging between 6.8% and 7.3% interest on its home loans. Generally, when RBI hikes the repo rate, it increases the cost of funds for banks. Banks will have to pay more for the money they borrow from RBI.

The first hike was to the tune of 40 bps in May and then 50 basis points in June. It again raised the repo rate by 50 bps in August and then again by 50 bps in September. Considering the recent hike of 35 bps, the total rise comes to 225 bps. This offer is exclusively applicable for applicants who are employed and self-employed professionals/non-professionals with a credit score of 750 and above. The interest rate of 8.4% is applicable on Home Loans, Balance Transfer Loans, House Renovation and Home Extensions Loans, stated the website.

Why Mortgages Will Become More Costly After Today’s Fed Rate Hike

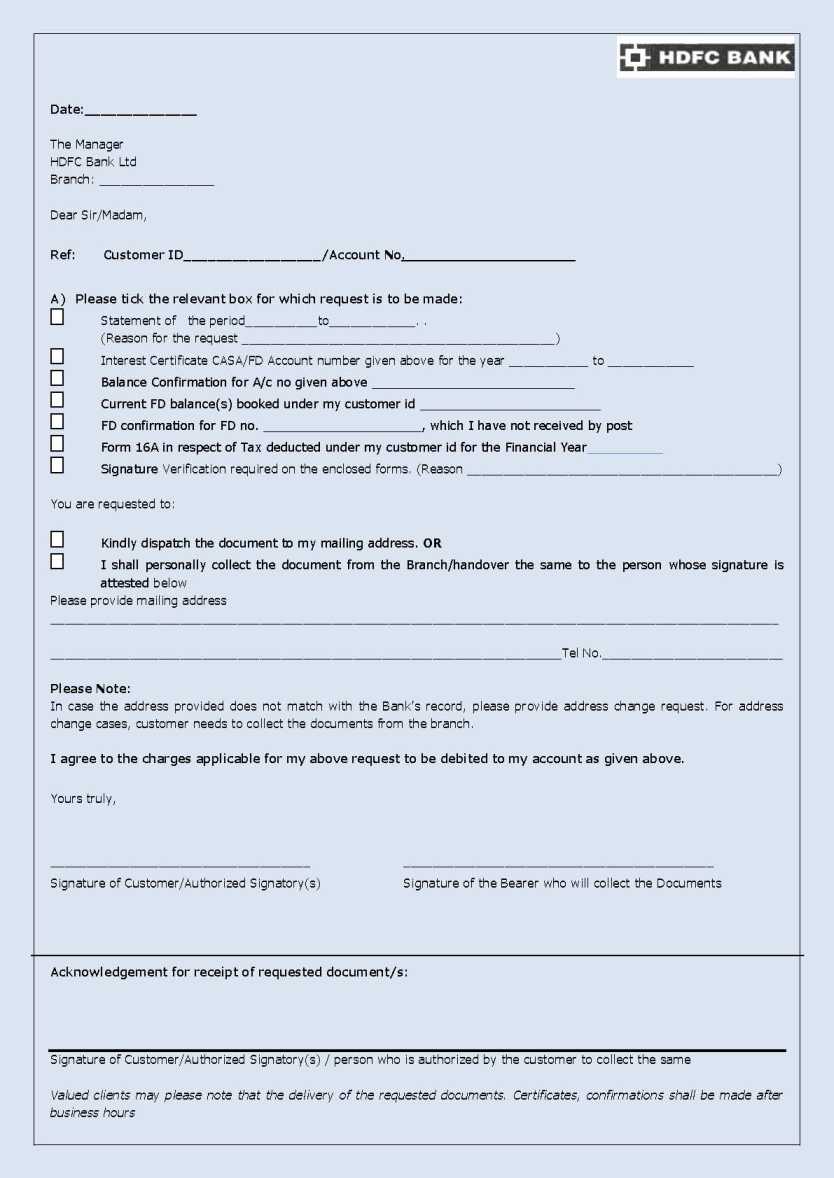

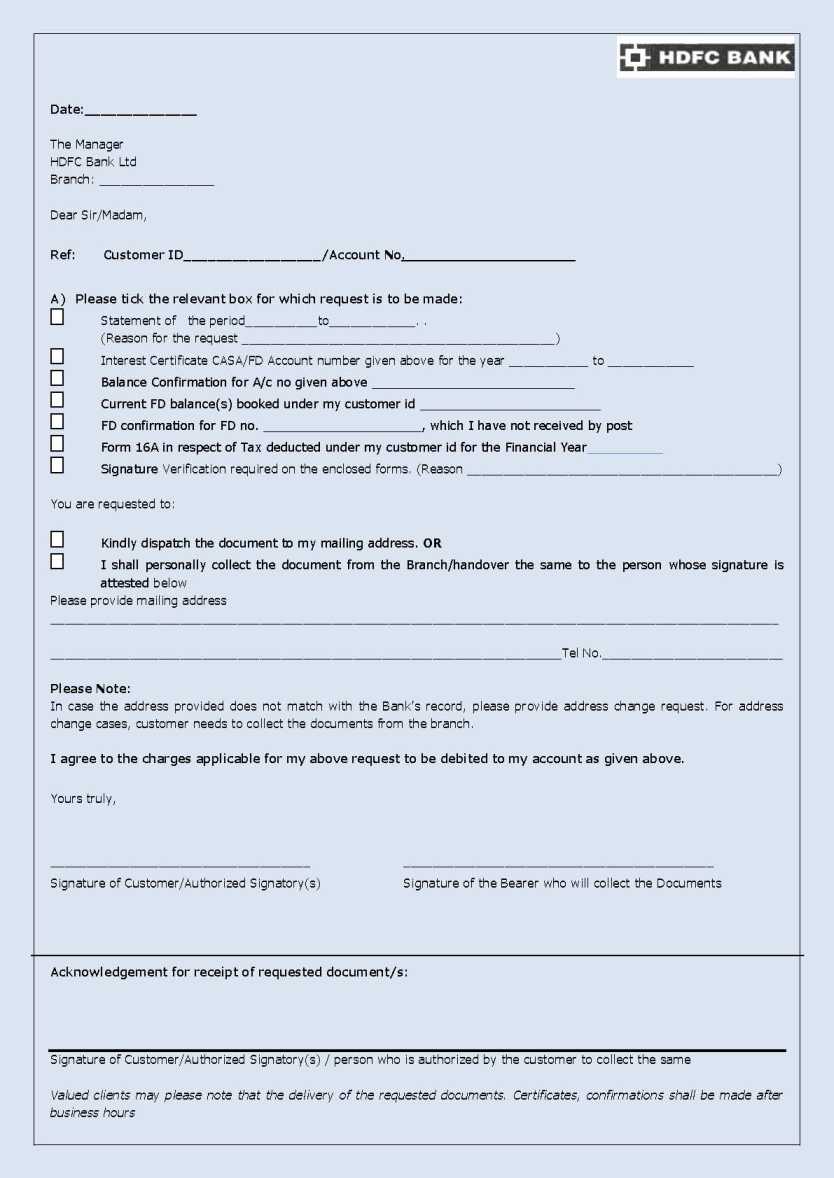

You can use HDFC Home loan interest rate calculator and calculate the effective rate of interest instantly online. The rate of interest is decided as per lender’s internal policy. Existing home loan customers wishing to reduce or reset EMI or tenure can apply for HDFC Home Loan Balance Transfer. You can opt for lower HDFC Home Loan interest rate and adjust loan principal and tenure according to your requirements. You are just a few clicks away from the best Home Loan offer in your city. Currently home loan interest rate starts at 8.20% p.a for all loan amounts.

Applicants should consider these factors carefully before applying for a home loan with HDFC to increase their chances of loan approval. These revisions are due to changes in Base Rate or change in the lender policies. Under the latter condition, the interest rates can be revised by SBI. These articles, the information therein and their other contents are for information purposes only.

Loan Schemes & Articles

Rates on 5-year fixed-rate loans averaged 17.20%, up from 15.54% the previous seven days and up from 14.05% a year ago. Rates on 3-year fixed-rate loans averaged 12.70%, down from 12.78% the previous seven days and up from 10.99% a year ago. As per the regulatory filing, the 1-year MCLR is hiked by 20 basis points to 8.25 percent from the current 8.05 percent.

After which the home loan interest rate has come down to 6.65 percent. Kotak Bank has claimed that its offer is the cheapest in the home loan market. The bank said in a statement that it is a special offer that is in force till 31 March 2021. The private lender has stated that the interest rates will be linked to the credit score of the borrowers and the loan to value- LTV ratio.

KOTAK MAHINDRA BANKHome Loan

This Offer will be applicable to all new loan applications irrespective of the loan amount or employment category. This is a close-ended scheme and will be valid till 31st October 2021,” said HDFC. By 50 basis points to bring it at 5.40%, HDFC has announced a 25-basis-point increase in its retail prime lending rates. With the hike in rates, home loans with HDFC will now come in the 8.05% to 8.55% range, based on the borrower’s creditworthiness and loan amount.

With fixed-rate mortgages, the interest rate is locked in for the duration of the loan,... Potential home buyers already spooked by the highest mortgage rate in 14 years aren't likely to feel much better after the Federal Reserve's next rate hike, scheduled for Sept. 21, 2022. As GOBankingRates reported on Tuesday, consumer prices in November eased to 7.1% — lower than most economist projections. Treasury bonds, which caused both yields and mortgage rates to fall. Just remember, if you default on the loan, your cosigner will be on the hook to repay it. Too many hard inquiries on your credit report in a short amount of time could lower your credit score.

In the last couple of years, property prices have more or less remained the same in major pockets across the country while income levels have gone up. Record low interest rates, subsidies under PMAY and the tax benefits have also helped,” said Karnad. Yes, all customers can avail of tax benefits on their home loans under the Indian Income Tax Act, 1961. They are eligible to get tax benefits on the home loan principal amount and also on its interest components. However, these tax benefits are subject to changes as per the tax laws.

People with low credit scores or disputable credit history may not get low interest rates due to the high-risk factor of repayment involved. On the contrary, applicants with a reasonable credit score can easily secure an affordable home loan with the bank. HDFC Home Loans also provides low cost affordable home loans which are specially designed for Indian residents who are salaried individuals and have a minimum income of Rs.10, 000 per month.

The effective rate of interest of your HDFC Home Loan is determined according to HDFC Ltd internal costs of raising new funds. Home Extension loan can be taken if the borrower wants to extend the space in his home by constructing new rooms or floors. Home Improvement loans can be taken for home renovation purposes.

Seeking funds to buy a plot, a new or an under-construction house in a rural area? You can get the same from HDFC Limited as part of its rural housing finance scheme. The rates for the same are shown below across different loan amounts. HDFC Home Loan interest rates are one of the best in the market. The rates differ according to the loan amount, as well as the gender and profession of an individual.

The HDFC website states that the holiday deal is valid through November 30 and that borrowers who have a minimum credit score of 750 are eligible for the reduced rate. After the Reserve Bank of India last lifted its repo rate by 50 bps to control inflation, major banks and mortgage players upped their lending rates by up to 0.50 percentage points. A number of lenders, including HDFC Bank and Bank of India, hiked their benchmark lending rates after Reserve Bank of India announced a repo rate hike by 35 basis points. As a result, the equated monthly installments of these banks will get expensive for those who avail consumer loans such as home and auto loans against the benchmarks.

If a higher loan amount is taken, it has a higher rate of interest. Home inventory remains about 40% shy of where it should be, according to Andrew Walden, vice president of enterprise research strategy at Black Knight. Just enter how much you want to borrow and you’ll be able to compare multiple lenders to choose the one that makes the most sense for you. But don’t worry, comparing rates and terms doesn’t have to be a time-consuming process. So, if you’re planning to take a home loan or already have taken one, then consider these 7 essential tips to reduce the interest payable. Apply for instant home loan online at Interest Rate starting from as low as 8.25% p.a.

HDFC home loan rate in June 2021

Starting with the overnight rate, the MCLR durations extend up to three years, with long duration products like home and auto loans linked to the one-year rate. For such products, banks have a mark-up over the one-year MCLR, depending on the risk perceptions, which becomes the final rate. You don't have to (and shouldn't) accept the first interest rate you receive from a mortgage lender. According to Freddie Mac research, comparing offers from at least four lenders can save you $3,000... The average rate on the 30-year fixed mortgage declined to 6.28%, CNBC reported, continuing a recent slide.

You can see for yourself how the interest gets reduced drastically for loans with shorter tenures by using a home loan EMI calculator. So, before you sign up for a loan, choose the tenure carefully so that you don’t end up paying higher interest against your loan. Kotak Mahindra Bank has also announced a 10 bps reduction in home loans.

No comments:

Post a Comment